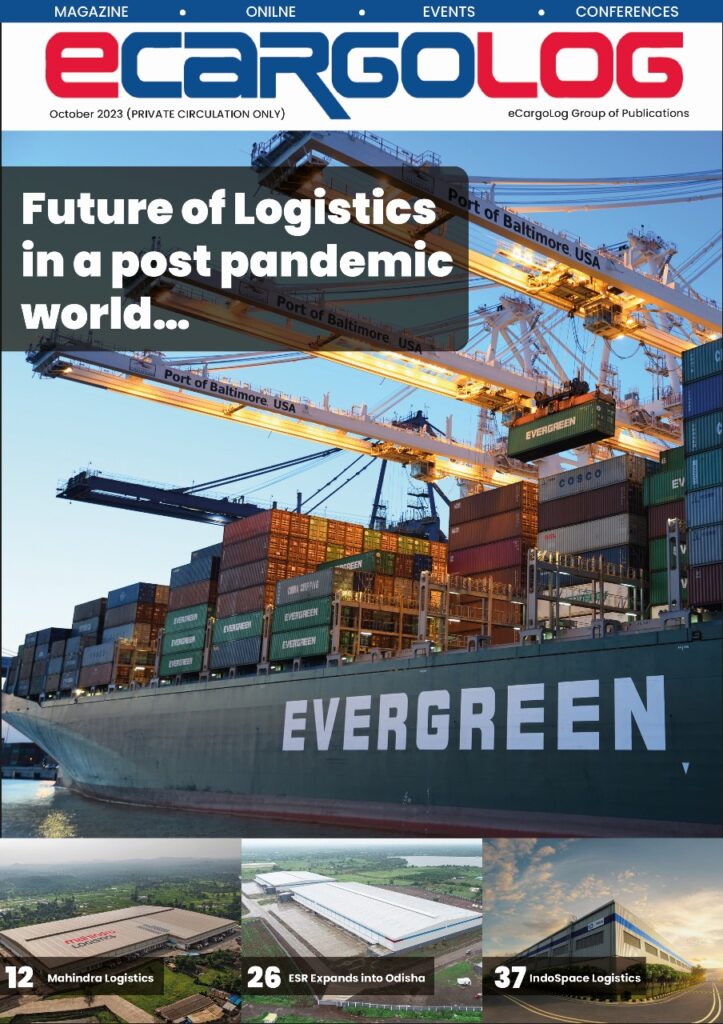

Shipping sector on choppy waters following Covid-19 outbreak; however, tanker segment likely to buck the trend: ICRA

The recovery in the shipping sectors will depend on the recovery in global economic activity, post abatement of the pandemic however, the timeline remains uncertain

The credit profile of Indian shipping companies is expected to remain under stress in the near-term and companies which are highly leveraged, will be adversely impacted by the downturn

The shipping sector is facing a challenging time due to the Covid-19 outbreak and its impact on global trade. As per ICRA note, the near-term outlook for major shipping segments like dry bulk, containers and offshore is negative. The exceptions to this trend are oil tankers wherein the sharp drop in oil prices has led to an increase in demand – both for supply of oil and for floating storage. As a result, the tanker rates have witnessed a significant increase though the sustainability of these high rates, beyond the near term, remains to be seen. While the overall outlook is challenging, in the near-term, the impact on shipping companies with a high share of tankers should be mitigated due to the high tanker rates.

Regarding the impact on the domestic shipping sector, Mr. K. Ravichandran, Senior VP and Group Head, ICRA Ratings, said, “The credit profile of Indian shipping companies is expected to remain under stress in the near-term and companies which are highly leveraged will be adversely impacted by the downturn. The implementation of the IMO-2020 norms has also led to an increase in operating costs for the sector, due to higher cost of low sulphur fuel, although the drop in crude oil prices has mitigated the impact to an extent. The coastal shipping segment, which had witnessed healthy growth in the last few years, supported by the Government’s push to increase share of transportation of this segment, will also witness some adverse impact in the near term, mainly in the container segment, whereas the impact on the bulk segment may be limited due to largely the essential nature of those commodities, which will not be impacted by the lockdown.”

Although the impact of pandemic is currently evolving, most of the major economies starting with China have implemented extended lockdowns, leading to disruption in supply chains and severe slowdown in economic activities is expected in major regions. The charter rates for dry bulk and container segments have witnessed a steep moderation in the last two months. Further, the steep fall in crude oil prices, following OPEC’s inability to arrive at an agreement for production cuts, is expected to result in moderation in E&P activity at least over the next six months to one year, which is going to have an adverse impact on the offshore segment.

The recovery in the global shipping sector will be contingent on the recovery in global economic activity. Commenting on the same, Mr. Sai Krishna, AVP, ICRA Ratings, further added, “The recovery in the shipping sectors like dry bulk and containers will depend on the recovery in global economic activity, post abatement of the Covid-19 outbreak, starting from China, the timeline for which remains uncertain at present as the crisis is still at an evolving stage. Further, any major changes in global industrial supply chain, during the recovery phase will also have an impact on shipping trade routes. Additionally, a supply side correction in the form of increased scrapping, should also be beneficial for the sector in the recovery phase.”